are delinquent property taxes public record

The lists below are published to notify taxpayers of delinquent real estate and personal property taxes that are subject to enforced collection action s. The specifics about each countys sale along with a listing of each certificate of delinquency are required to be advertised in the local newspaper at least 30 days prior to the.

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Delinquent Real Estate Taxes.

. When it comes to taxes it can be hard to find delinquent properties There are many places you can search for these properties including county tax offices and the property tax lien records. If the property cannot be located or is sold for. See Available Property Records Liens Owners Mortgage Info.

Submitted to the Herald Record Author. Delinquent tax sale begins at 1000 am. The Tax Office accepts full and partial payment of property taxes online.

Delinquent Property Tax Search. Doddridge County COVID Count. Search Any Address 2.

The Irving City Council adopts a tax rate for property taxes each September when the budget is approved. Ad Find All The Tax Records You Need In One Place. Publication of Delinquent Real Estate Taxes.

Once subject to power to sell it will be notated on the Delinquent. Ownerly Helps You Find Data On Homeowner Property Taxes Deeds Estimated Value More. Except as otherwise provided in section 79 for certified abandoned property on the October 1 immediately succeeding the date that unpaid taxes are returned to county treasurer for.

Delinquent tax records are handled differently by state. The property owner may retain the property by redeeming the tax deed application any time before the property is sold at public auction. On or before June 1st a tax certificate - or lien against the property - is issued for the amount of the unpaid taxes penalties and costs.

A 3 minimum mandatory charge and advertising charge is imposed on April 1. By Submitted to the Herald Record on May 18 2022. Ad Request a Free Quote.

Mail all documentation to. Terms of the Property Tax Division Public Auction Sales. The court costs are added to the delinquent tax bill.

On top of those ongoing penalties theres a 20 collection fee thatll slam you. If payment is not received at the Tax Collectors office before June 1st a. 112 State Street Room 800 Albany NY 12207.

Visit Our Website Today. View the tax delinquents list online. A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question.

Property taxes are collected by the Dallas County Tax Office in one installment. Seizes property for non-payment in. Delinquent Taxpayer Lists.

County Date of Sale Downloadable PDFs Type of Sale. Delinquent Taxes and Tax Foreclosure Auctions. Property that remains in tax-defaulted status for five or more years will become subject to the Tax Collectors power to sell.

It is recommended that a tax claims search be conducted in the same time period as a real estate closing to minimize any potential problems or miscalculations. In other words if delinquent property. We are Here to Help.

The Delinquent Tax office investigates and collects delinquent real property taxes penalties and levy costs. Finds and notifies taxpayers of taxes owed. REAL PROPERTY DELINQUENT TAX.

Location to be determined extra copies of the lexington chronicle will be sent out to chapin cayce gaston irmo pelion swansea and west columbia to. For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. Typically a tax lien is placed on the property by the government when the owner fails to pay the property.

If you owe delinquent property taxes youll get hit with an additional 2 penalty for every month you havent paid. Records in the Office of the Clerk and Master Property Assessor Register of Deeds for Campbell County Tennessee show the following information pertaining to the. Stop Worrying with Monthly Payment Plans.

Interest on the tax certificate accrues at a minimum of. The Tax Collector is then empowered to seize and sell the personal property to pay the taxes. The page following provides a list of upcoming public auction sales.

105-3651 b 1. Contact for View the Public Disclosure Tax Delinquents List. Prior to current year delinquent taxes being put in the delinquent records of the County Treasurer they are published in a county newspaper of.

Get Records Retrieval For Arkansas Tax Today. Tax Department Call DOR Contact Tax Department at. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with.

Notice Of Delinquency Los Angeles County Property Tax Portal

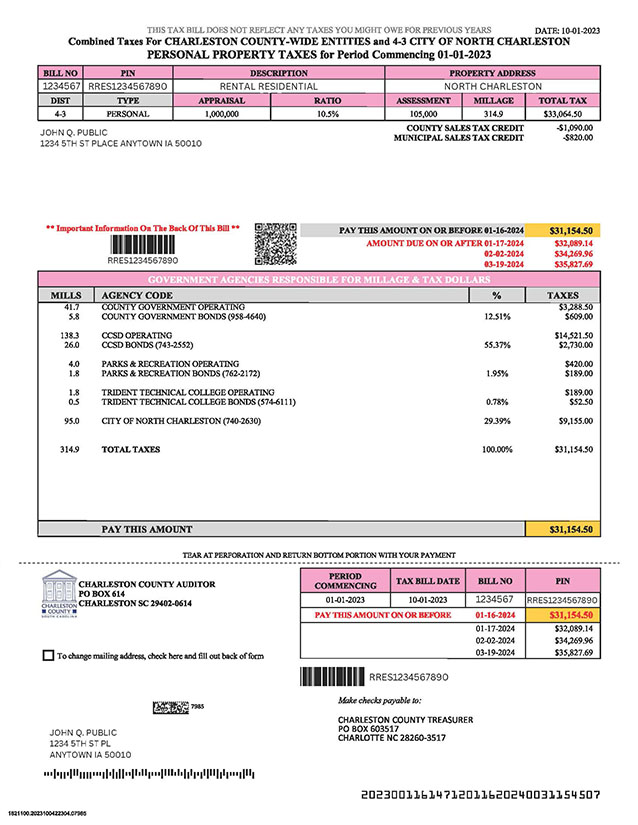

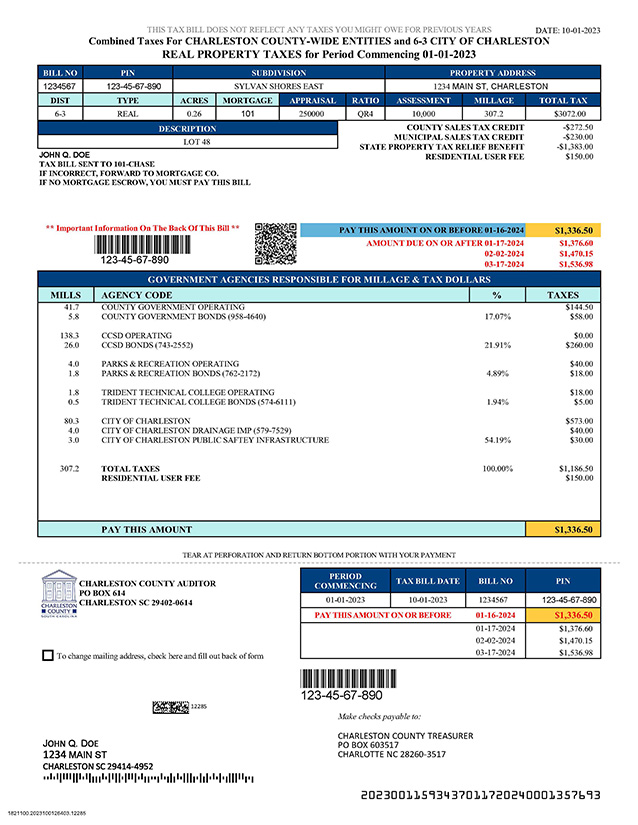

Sample Real Property Tax Bill Charleston County Government

Sample Real Property Tax Bill Charleston County Government

Understanding Your Property Tax Bill Clackamas County

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Secured Property Taxes Treasurer Tax Collector

How To Get Delinquent Property Tax Penalties Waived Update State Covid Waiver Program Has Ended County Of San Luis Obispo

Unsecured Property Tax Los Angeles County Property Tax Portal

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal

How To Read Your Property Tax Statement Snohomish County Wa Official Website

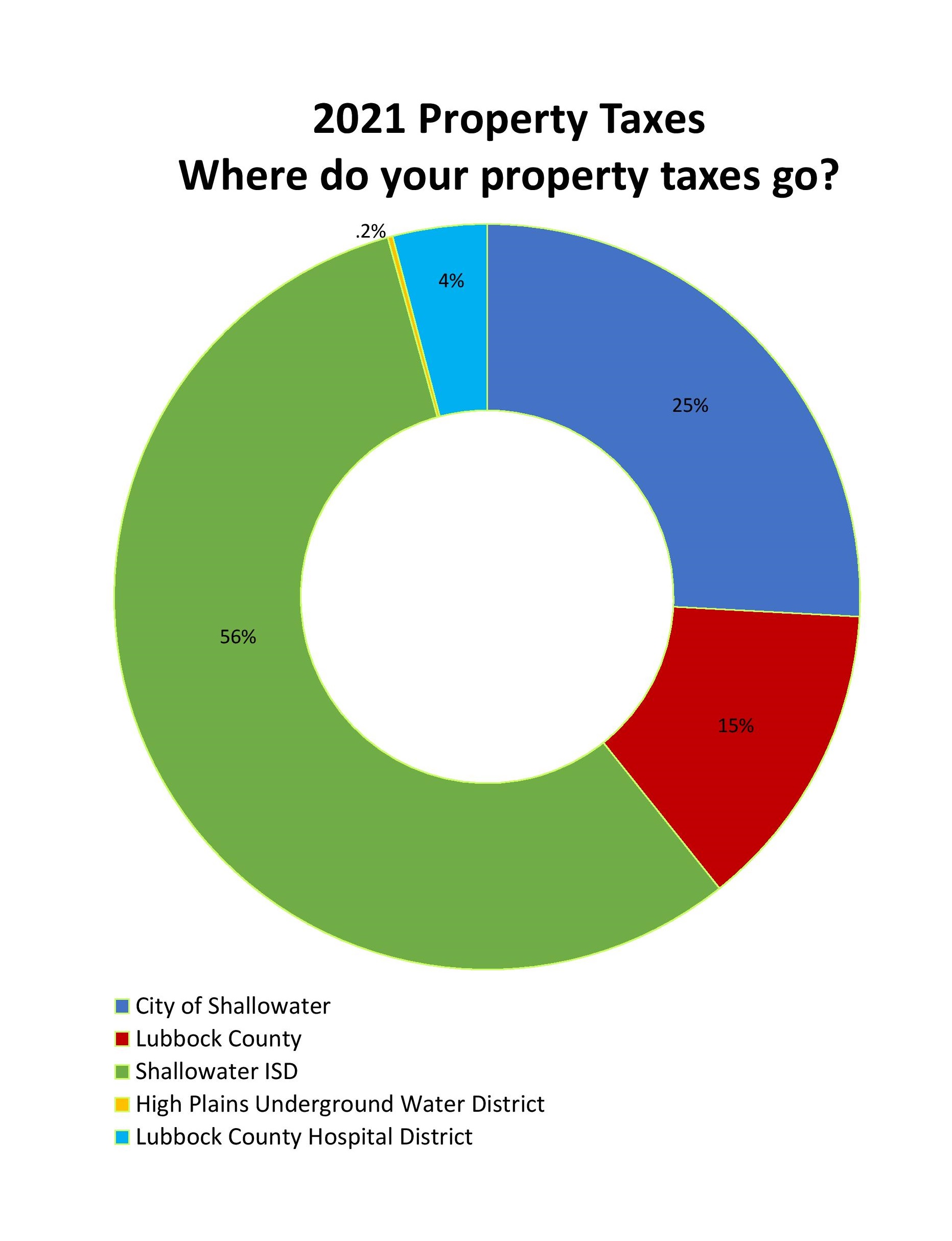

Property Taxes Shallowater Texas

Adjusted Supplemental Property Tax Bill Los Angeles County Property Tax Portal